If you are struggling to manage your personal financial affairs, your savings have stalled or you’re feeling you’re not getting ahead financially, it’s time to take back control. Here we explore the important matters of personal cashflow and debt management.

The demands of running a business can leave business owners time poor, and this often results in neglecting their own personal financial affairs. For many business owners, commonly those in their 30’s and 40’s, escalating expenses and debts associated with their lifestyle cause further concern.

Understanding your cashflow

The first step toward achieving personal prosperity is to understand the balance of how much you are earning versus where your money is going (you may be surprised). Your individual expenditure needs will depend on your stage of life and lifestyle objectives.

By understanding your cashflow, we can help you prioritise expenses into essential and non-essential and use modelling that will help you make decisions associated with your financial goals so you may make the most of your money.

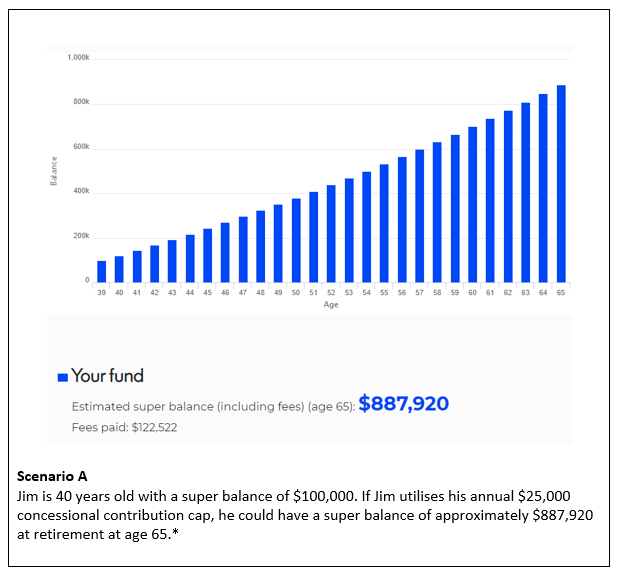

Scenario planning can aid your financial decision making. For example, we can use modelling to illustrate possible outcomes for superannuation. As indicated below there can be a considerable difference when you maximise your super contribution to the annual cap.

Debt management

Debt management

Debt can impact your stress levels and general wellbeing, and it can also have long term implications for your financial future. There are many debt management strategies that can make a positive difference to your debt position and overall financial outcomes, such as:

- Prioritising to pay off debts with the highest interest rates or consolidating debts to save on interest.

- Refinancing your home loan, addressing the frequency of your payments or considering offset accounts and other mechanisms to manage your debt more effectively.

- Using debt for wealth accumulation such as borrowing to purchase shares or investment properties. Often the interest associated with this debt is tax deductable.

- Identifying tax efficiencies or more effective ways of structuring debt aligned to your long-term financial goals.

As business owners ourselves, we understand the challenges of running a business, building personal wealth for life beyond business by making the most of personal cashflow and managing debt effectively.

If you would like to know more about strategies to improve your financial position and building your personal wealth, I encourage you to give us a call on 03 9708 8801 or email info@rvpartners.com.au.

At Robinson Voss Partners, we have over 40 years combined experience and expertise in specialised tax issues, accounting, business, and financial advice. We are single-minded in our goal to help our clients achieve business success and personal prosperity.

Link to article 1: COVID-19 shines the spotlight on personal asset exposure.

Link to article 2: Wealth accumulation for business owners.

General Advice Disclaimer: The information contained on this webpage has been provided as general advice only. The contents have been prepared without taking account of your objectives, financial situation or needs. You should, before you make any decision regarding any information, strategies or products mentioned on this webpage, consult your own financial advisor to consider whether that is appropriate having regard to your own objectives, financial situation and needs.

* Superannuation Calculator Assumptions and Disclaimers

Fund fees are set at default with Admin fees predicted at $74 per annum. Investment returns are 7.5% per annum with 7% tax on earning per annum and investment fees at 0.85% per annum. A full list of disclaimers and assumptions can be found here: https://moneysmart.gov.au/how-super-works/superannuation-calculator